The Department of Insurance, Securities and Banking (DISB) wants District residents who work in public service to be aware that the deadline for applying to the Temporary Public Service Loan Forgiveness Waiver Program (PSLF waiver) is October 31.

About The PSLF Waiver

If you have a federal student loan, time is running out to take advantage of the Temporary PSLF Waiver Program implemented by the Biden Administration. DISB provides support navigating the PSLF waiver process. You can also access four-minute video vignettes on each phase of the process at forgivemystudentdebt.org.

The PSLF program offered by the U.S. Department of Education (ED) forgives the remaining balance of a Direct Loan for borrowers while they are working full time for government or nonprofit employers. Borrowers must enter a qualifying repayment plan and make 120 monthly payments to be eligible for loan forgiveness. View Frequently Asked Questions about the PSLF Program here: disb.dc.gov/page/pslffaqs.

Action Steps

In 2021, the Biden Administration added a waiver to the PSLF program, which provides credit for past payments made on loans that would otherwise not qualify for PSLF (for example, a Federal Perkins Loan or Federal Family Education Loans). To take advantage of this waiver, you must act fast. The waiver period ends October 31, 2022. Here’s what you have to do:

- Check your loan types by logging into your dashboard at studentaid.gov. If you see any loan type other than “Direct,” you must consolidate your loans before October 31, 2022. If you need to consolidate, go to step two; if not, skip to step three.

- Apply to consolidate your federal loans into a Direct Consolidation Loan at studentaid.gov/app/launchConsolidation.action. If you are married and file your taxes jointly, you will receive a code and instructions for your spouse to affirm your joint income for purposes of the repayment plan. Although spouses who file jointly are required to sign, the non-borrower spouse is not financially responsible for the federal student loan debt by signing the documents related to the consolidation process. Note: Consolidating borrowers no longer must wait for proof of transfer of their student loans to complete and submit their PSLF application using the PSLF Help Tool. From now through October 31, ED will save the information submitted through the PSLF Help Tool and the Missouri Higher Education Loan Authority (MOHELA) will match it to any corresponding consolidation applications.

- Use the PSLF Help Tool to apply for PSLF and take advantage of the waiver program: studentaid.gov/pslf. If all of your loans are direct and you do not need to consolidate, you can go straight to the tool and do not need to download the paper form.

- After filling out Sections 1 through 3 of the PSLF Help Tool online, you will need to sign and send the completed Employment Certification Form to your employer’s Department of Human Resources (HR) to complete Section Note: Depending upon your employment history since 2007, you may need to repeat this step for multiple employers. You must sign with a wet signature before sending it to HR. The ED will not accept electronic signatures even if time stamped. Remember to save a copy for your records. HR will complete Section 4 and return it to you for submission via email. In some instances, HR may correct information included in Section 3 if it does not match their records. After HR returns the completed form to you, it must then be submitted to the address identified in Section 7.

- Once you receive the completed application from your employer, you must mail or fax it to the MOHELA at the address indicated in Section 7 of the Form:

U.S. Department of Education, MOHELA

633 Spirit Drive

Chesterfield, MO 63005-1243

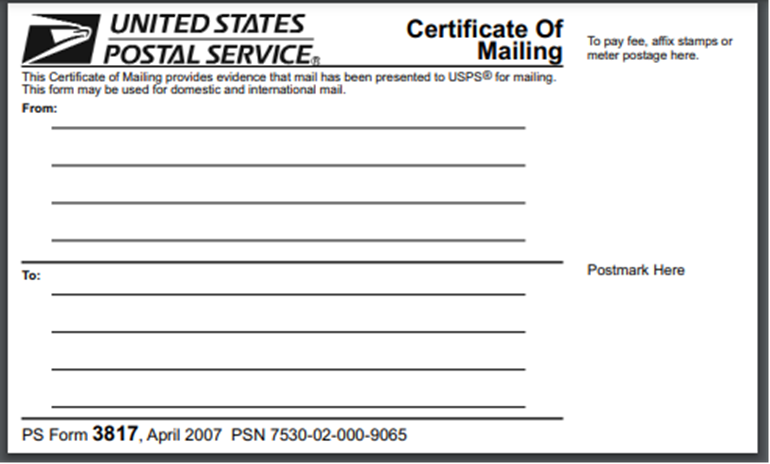

If you are mailing the form, please consider going to the post office to complete the USPS Form 3817: about.usps.com/forms/ps3817.pdf to obtain a certificate of mailing

Or fax to: (866) 222-7060

If MOHELA is already your servicer and you have an active account, you can also upload it to: mohela.com/uploaddocument.

Resources

Be sure to apply for this waiver before it expires on October 31, 2022. For more information on the PSLF process, visit the Student Loan Ombudsman’s website at disb.dc.gov/page/student-loan-ombudsman-webinars, which has a webinar on completing the waiver process as well as a step-by-step PDF presentation.

DISB Mission

Our mission is three-fold: (1) cultivate a regulatory environment that protects consumers and attracts and retains financial services firms to the District; (2) empower and educate residents and (3) support the development and expansion of business.

Social Media

DISB Twitter: @DCDISB

DISB Instagram: instagram.com/disb_dc

DISB Facebook: facebook.com/DISBDC

DISB Website: disb.dc.gov